Reverse Stock Split?

What Is a Reverse Stock Split? These Examples Can Help

Here’s what you need to know about reverse stock splits.

What is a reverse stock split?

In some ways, a reverse stock split is the opposite of a forward split. In a reverse stock split, a company reduces the number of its outstanding shares. For example, if you owned 500 shares of XYZ Corp. and the company announced intentions for a one-to-five (1:5) reverse split, your 500 shares would be converted to 100 shares. The price of each new share would increase by that five multiplier, so if XYZ was $2 before the reverse split, it’d quintuple to $10 after the reverse split.

Typically, a company will announce a planned stock split or reverse stock split in a press release, though the company may not specifically say “reverse” or “split.” General Electric (GE), for example, said in June 2021 that it “received all necessary approvals” for a 1:8 “consolidation” (another term for reverse split) of its common shares.

Following a reverse split, neither the market value of the company’s outstanding shares nor the value of your shares change. In that regard, a reverse split has the same effect as a forward split: no change in market value, and other key financial metrics also remain the same.

How often do reverse stock splits happen?

Reverse stock splits happen several times a year, but most of the time, they generate little attention from the financial media. Often, reverse splits involve smaller, lightly traded companies in different industries—energy, mining, biotechnology, Chinese real estate—as well as some exchange-traded funds.

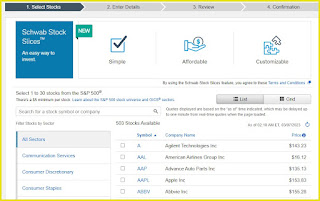

Looking for planned stock splits and reverse stock splits? Here are two ways:

- Log in to your account on tdameritrade.com. Select Research & Ideas > Markets > Calendar. Then select Splits.

- Log in to your account on the thinkorswim® platform. Under the MarketWatch tab, select Calendar, then Split.

Why do companies do a reverse stock split?

One common reason for reverse stock splits is to boost a sagging stock price. Reverse stock splits often involve companies whose share prices have tumbled, possibly into penny stock status. Because the NYSE and other major exchanges have minimum prices at which a company’s shares must trade, reverse splits are often done to avoid being delisted by the exchanges. Additionally, some mutual funds and other institutional investors won’t buy shares of companies below a certain price.

If a company faces a potential delisting and/or is doing a reverse split, it’s likely the business is struggling. Unless there’s a compelling reason to think the stock may bounce back, these are stocks long-term investors may want to consider avoiding.

What are some reverse stock split examples?

GE shares were trading below $13 when the company announced its 1:8 reverse split. Did the reverse split “work out” for the company and its investors? Maybe, maybe not. The answer depends in part on your time horizon.

Reverse splits can provide a temporary lift for a company’s shares. As of March 2023, GE shares were trading above $90, but the stock was still down more than 75% from its all-time high set back in 2000.

Looking further back, the 2008–09 financial crisis led to a few reverse split examples among big Wall Street banks and related companies. In mid-2009, as American International Group (AIG) shares slumped near $1, the insurer did a 1:20 reverse split (in November 2020, AIG shares were around $38). In another example, Citigroup’s (C) 1:10 reverse split helped lift shares that had dropped under $5 (C shares are currently around $44).

What should investors keep in mind with reverse stock splits?

It’s important for investors to remember that reverse splits are done at least partly for cosmetic or psychological reasons. Over the long term, a stock price’s direction is driven by cold, hard numbers, such as earnings and revenue.

A reverse split may indeed flash a “buyer beware” signal. But, like many forms of company news, it’s a good idea to dig deeper into a company’s financial statements and other publicly available information to uncover the full story.

Comments

Post a Comment

Thank you.